After over a decade of "passive investing" dominance, a shift is underway. Active management rewards investors who can skillfully blend between and shift within different asset classes, a seemingly fruitless exercise until recently. When everything is going up in value, there's little-to-no value in doing so.

In recent days, Fed Chairman Jay Powell reiterated in no uncertain terms that he's waging a war on inflation. We believe this is the most critical variable that markets are now trying to solve. Here's an excerpt from Powell on May 17th:

"I guess I would say this: we have to get inflation down to 2%. We have to restore our definition of price stability, and we will do that. It will be challenging to do that. We have to slow growth to do that. The idea is growth has to move down. That is what has to happen for inflation to go down. We don't have precision tools, we can't say let's dial into this exact level. We raise interest rates, which impacts financial conditions which impact the economy. There are a couple of steps there. It is not in any way a certain precision. I would say there could be some pain involved in restoring price stability."

In short… the Fed is willing to inflict pain on the stock market and other assets to stop prices from rising, at least at the current pace.

It's our opinion that the bottom in the stock market will likely occur when inflation begins to ease. Therefore, it's critical to understand when that's likely to take place. Some people speculate this will mean many more rate hikes. After all, the Fed has only increased rates by 75 basis points, which may seem piddly. But markets are forward-looking. If you're a bank and the Fed is telling you they plan to increase rates aggressively, are you going to make loans considering the current interest rate environment? Or are you likely to extrapolate future rate hikes into your calculus?

In effect, the financial system is already adapting thinking to be ahead of the "curve." Mortgages have skyrocketed. Corporate bond yields have surged. Lending standards are surely tightening. The net effect of this type of thinking by financial institutions is very constrictive on the overall economy.

While the Fed is tightening, the global supply chain, which has been suffocated throughout Covid, is working to correct itself. Shortages will inevitably lead to surpluses, but we are not there yet. It was not too long ago that people believed oil would never again eclipse $100 barrel, and many investors swore off ever investing in fossil fuels again. Oops!

As the market continues to look into the future to determine exactly when an end is in sight for inflation, we expect the news on inflation to be a complicated stream of starts and stops.

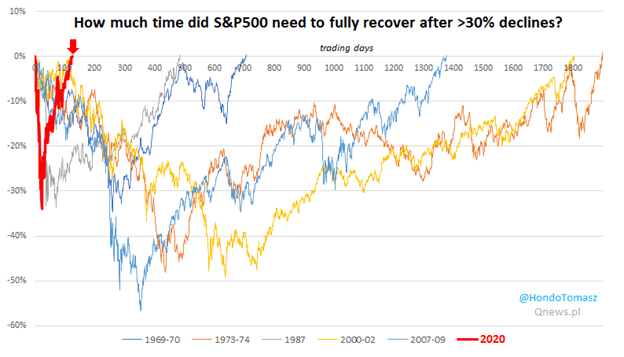

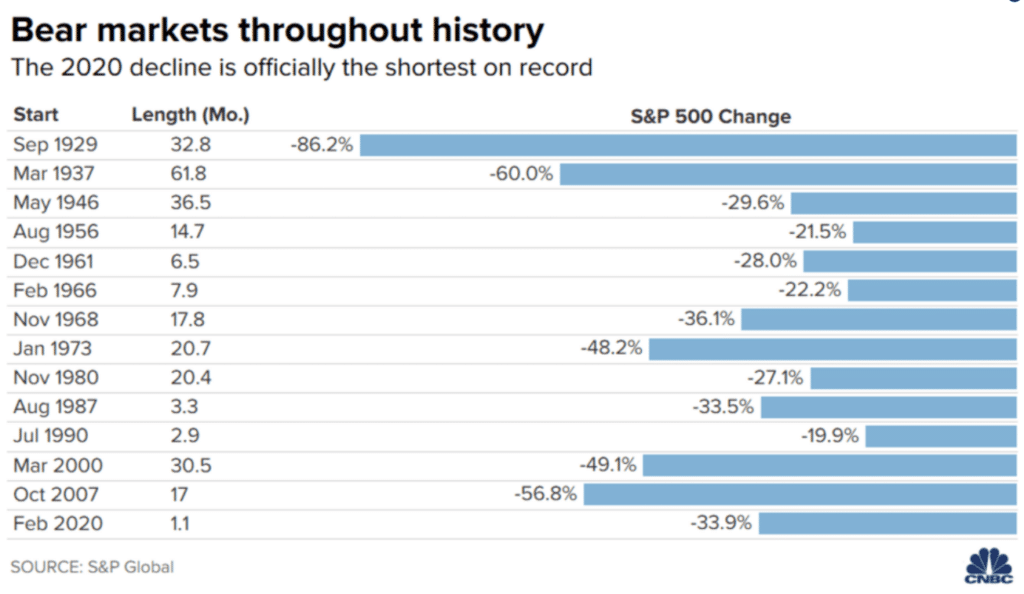

If market sell-offs intensify, the game plan of playing defense needs to adapt to that of playing offense. When that perfect moment comes to pivot is impossible for anyone to know exactly. However, a systematic discipline that reduces emotional thinking in favor of data-driven decisions is fundamental to Evergreen's investment process. Buying things that are declining in value is often not quickly re-enforced with the desired result. If every time the market went down it immediately rebounded, it would be easier to be a good investor. Ironically, however, the most recent market crash at the start of the Covid pandemic happened precisely this way, but this is atypical. The markets fell in the blink of an eye by 34% from 2/19/2020 to 3/23/2020, only to revisit highs a mere four months later. For context, on average, it typically takes the markets 20 months to recover from a bear market decline.

Investors who are hoping for a quick market rebound and resumption of a bull market will not have the benefit of history on their side. The anatomy of the last market decline was markedly different from the situation we are facing today. The pandemic was an exogenous shock triggering immense and well-founded fears as scientists raced to understand the severity of the health crisis. As more information began to emerge about the virus, markets quickly rebounded.

The issues of today do not have such a binary nature. The current market weakness is no doubt being caused by an obvious change in central bank attitudes, primarily driven by surging inflation. For over a decade after the Great Financial Crisis, Central Banks determined that low-interest rates would be the panacea for restoring economic health. Few debated the necessity of this, at least initially. As time went on, many began to warn that the eventual result of these policies would ultimately be significant inflation. These worries seemed to be unfounded. As markets soared and inflation remained remarkably subdued, the skeptics lost credibility. Then came the pandemic and along with it were unprecedented disruptions to a global supply chain that's never been more interconnected. Those who had been warning of inflation took off their hats and are now taking a long-awaited "victory lap" as prices for many goods and services skyrocket.

There's no doubt that the Central Banks printed a lot of money. Rates were kept low as savers were punished, and central banks encouraged investors into riskier assets, perhaps none being a more poignant example than the modern-day gold rush into cryptocurrency. We've all had to endure the stories about someone making a fortune buying some coin we couldn't pronounce. Seemingly confined at first to asset prices, inflation spread following the Covid pandemic to everyday goods and services.

Gas, rent, food, damn near everything costs more today than it did three years ago, by a lot! Pro-inflation evangelists argue that at some point, inflation becomes self-filling in nature. If a restaurant owner has to pay more for labor and ingredients, we should expect the prices on the menu to also rise. Next, the restaurant patrons dining there will have to raise prices at their respective businesses to pay for a higher dinner tab, and around and around it goes like a never-ending carousel ride. Eventually, we expect inflation to normalize, whether through the brute force of the Fed's rate hikes or because the kinky hose of the global supply chains straightens out. Frankly, many are seemingly giving up hope on the latter, banking on the former. I would point out that if inflation comes down via "natural forces" versus being beaten down by the Fed, a recession may be avoided. If it comes down to the Fed being the enforcer, it seems like a long shot that they will be able to thread the needle by tightening enough without throwing the economy into recession.

Financial Advisor Psychologist

Most clients believe they are hiring us because we possess a deeper knowledge and understanding of financial information than them. At times this matters, but in periods when markets behave erratically, our role as market psychologists trumps any empirical financial knowledge. Longer-tenured clients can look back to how we navigated the financial crisis or the fallout from the global pandemic for historical context. Newer clients, without the benefit of these experiences, will undoubtedly have more anxiety. In new client meetings, I often tell a story about investor behavior, so I apologize to those who find this redundant, but it sheds light on a critical aspect of successful investing.

We are often asked to summarize our investment philosophy. Unequivocally and no matter who you talk to at Evergreen, our investment DNA is "be fearful when others are greedy and greedy when others are fearful." Never in a meeting has a single client disagreed with this axiom. It makes intuitive sense to people, but there's admittedly a fundamental problem: nearly no one can bring themselves do it. This is also quite logical since investing goes against our most primal emotions. When we are scared, our brain changes the way it functions. This isn't some anecdotal observation I am making. Much research has shown that our brain functionally changes the way it processes information when a threat is perceived. Without boring you with scientific studies, the takeaway is simple. The part of our brain which typically processes information with logic and reason switches off when we are afraid. A different part of our brain creates a response that releases cortisol and adrenalin, causing our heart to pump faster and our muscles to tighten. This is caused not only by the presence of physical fear, like coming across a bear while hiking, but also by psychological fears like running across someone you don't like or, more relevantly, when losing money.

As I reflect on periods of market volatility, something very notable stands out. You may imagine that our client base is largely made up of long-tenured clients, with only a relatively smaller portion of clients who've joined us more recently. While we all wish markets only went up, every rational investor knows this is not reality. The more seasoned clients know the drill; they've gone through one, two, or more full market cycles with Evergreen. So it may come to our newer clients' surprise and discomfort that these times of increased volatility are actually quite beneficial for future portfolio returns. In 2008-09 as the market sold off indiscriminately, punishing so many areas of the market, we seized the opportunity. In many respects, we see volatility in markets as a "sale" at a department store. Of late, our clients who've been with us through prior bear markets have begun asking us things like "what are we looking to buy" or "what types of opportunities are you guys seeing." In the current market environment, we are already starting to see some attractive bargains. I'll give you one recent example….. a fear until recently we heard from clients was that their bond portfolios may never return to delivering the 4% return investors had grown accustomed to earning. Just last week, for many clients' accounts, we were able to purchase a DELL* bond paying a 5.5% yield with a 2028 maturity. We also recently purchased a United Airlines* bond secured by highly valuable jet engines yielding 6.5% with a 2026 maturity. These are just a couple of examples, but they are meant to highlight that clients can expect us to be constantly analyzing the investment landscape for opportunities as more novice investors rush for the exit. Should the current sell-off intensify, we know that many investments will trade down far below their long-term value. Buying into these types of investments will sow the seeds for strong future returns for our client base, no different than it did for them during the financial crisis.

One investing oddity is that each crisis looks different than the last. Today's headwinds are not driven by the financial system's indulgence on risky debt or a world health crisis. The once seemingly necessary monetary and fiscal policies have boomeranged back into the economy in the form of inflation. Couple that with geopolitical instability, and it's no surprise that market participants are skittish.

Today, many investors are left scratching their heads as they examine their options. Cash isn't very appealing with inflation running at current levels. Bonds, too, have been impaired by rising interest rates. Stocks are weakening as they begin to price in lower earnings expectations. Gone, for now, are the days when you could simply buy a bond ETF and stock ETF and call it a day. Today's market environment calls for investors to adapt to new conditions. Investors are being forced to think more critically about asset classes.

If I told almost any investor three years ago that Fuels, Aerospace & Defense, Agriculture, Nuclear and renewables, and Gold and metals/minerals were attractive areas to invest capital in, I would have been laughed at. Today, these investments are being dubbed FAANG 2.0. Seemingly, gone forever are the bright futures of the original FAANG (Facebook/Meta, Apple, Amazon, Netflix, and Google) stocks, which are down 50% on average. In investing, it never ceases to amaze me how quickly something goes from hero to villain and then back again.

The reality is that there are areas to invest in if you know where to look, but it's not the obvious investment 101 asset classes that have worked for over a decade. Alternative asset classes offer a unique opportunity, but they are less understood than more traditional assets. International markets did not enjoy the same levitation as US Markets during the past bull market. Value stocks have been in a long slump relative to their high-octane counterpart, growth stocks. The energy space has come back into favor partially because they've been out of favor for so long and perhaps more importantly because there's a renewed focus on energy independence highlighted by Russia's war in Ukraine. We aren't the only ones who believe there are opportunities to be had for thoughtful investors. Warren Buffet has been actively making investments of late. Volatility and market disruption give skillful investors a chance to separate the wheat from the chafe. One of our favorite quotes is, "when the tide goes out, you can see who was swimming naked."

No one enjoys periods of market uncertainty. It creates the type of primal fight or flight emotions I talked about earlier, but if we look back at our investment history, we find these periods to be the most beneficial for creating future returns for our clients. The panic of 2008-2009 sowed the seeds for our client portfolios in the following years. My advice to any investor is that behavior during tumultuous times typically falls into three distinct patterns. The first and assuredly the certain way to lose money in investing is to sell when you're scared and buy when the "coast is clear." The second way is to grit your teeth and simply do nothing, neither buy nor sell with the hope that eventually, the storm will pass. The final and most successful but the most difficult path is to systematically follow a process that allows you to capitalize on others lack of discipline by buying when panic ensues. While markets are still a ways off from the average historical decline in a bear market, should market conditions further deteriorate, we will be ready to do exactly what we've always done: choose logic over emotion and implement our process-driven approach to managing client assets.

\Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. There is no guarantee that yields stated in this piece will be achieved. Yields mentioned are gross of fees. These yields do not reflect the deduction of advisory fees, brokerage or other commissions, and any other expenses that a client may pay. Please note that the yield numbers are not intended to serve as projections of the performance.*

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.